Our offerings are modular

Risk management

- KYC

- Credit risk assessment

- Credit review

- Restructuring

- Recovery

Back office services

- Onboarding

- Fulfilment

- Payment and collection

- Arrears management

- Changes

- Monitoring

- Reporting

Product development

- Market information

- Product design

- Market validation

- Legal framework

- Technical framework

- Portfolio management

Distribution

- Marketing

- Activation through external financial advisors

- Activation through online portal

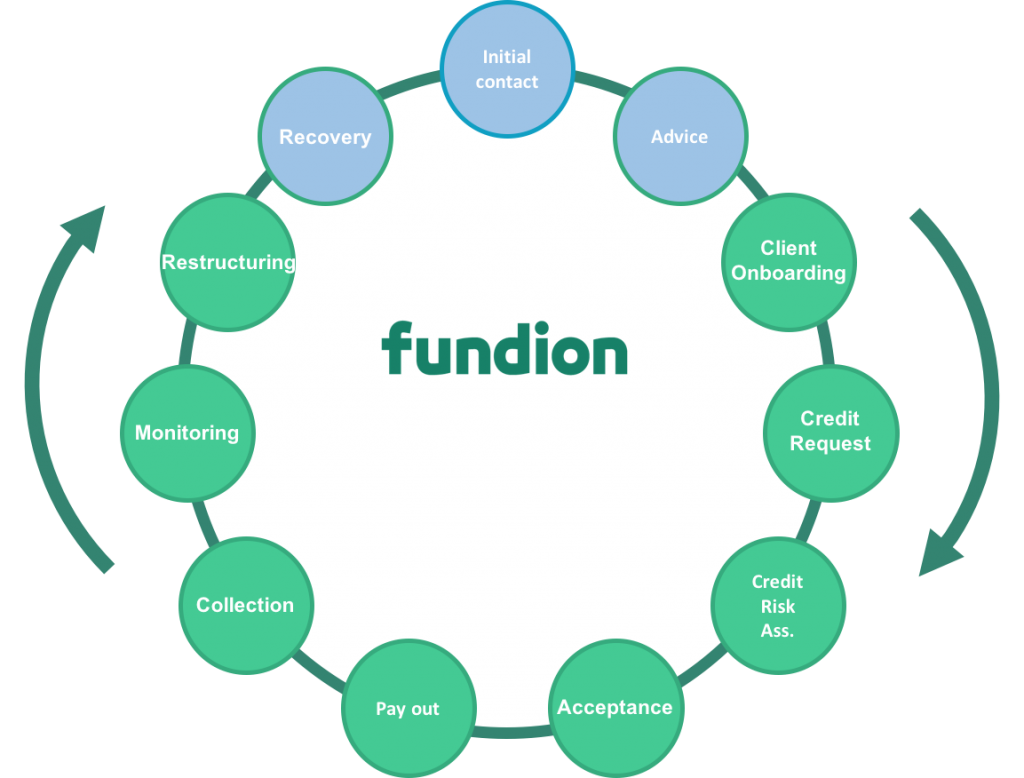

We offer you front to end access to the SME and CRE lending value chain

Fundion can fully service different type of products, such as term loans, mortgage loans, mezzanine loans, leasing and factoring.

Our promise to you

We manage the risk in your portfolio according to the highest standards using high-tech digital techniques combined with the professional judgement of experienced riskmanagers.

We fulfil your back office processes in an efficient and effective manner by means of our highly automated systems ensuring a high level of Straight Through Processing (STP)

We use our in-depth knowledge of the SME and CRE market and will help you build distinctive lending products

We have entered into partnerships with high-quality SME and CRE debt advisors and have established a strong foothold in the SME and CRE lending market place as well as a direct link to the SME entrepreneur and CRE investor.

Above all, however we offer your clients an optimal customer journey.